Moving Beyond DSO

Your Virtual Credit Manager

FEBRUARY 20, 2024

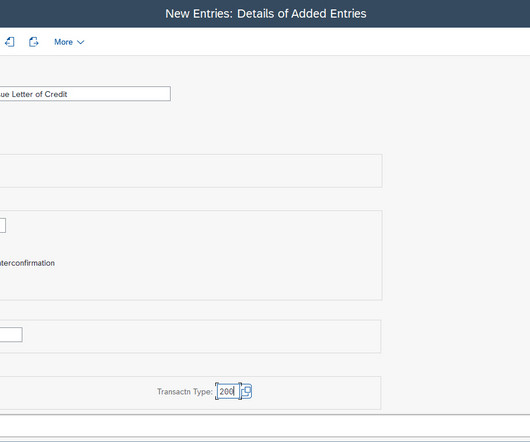

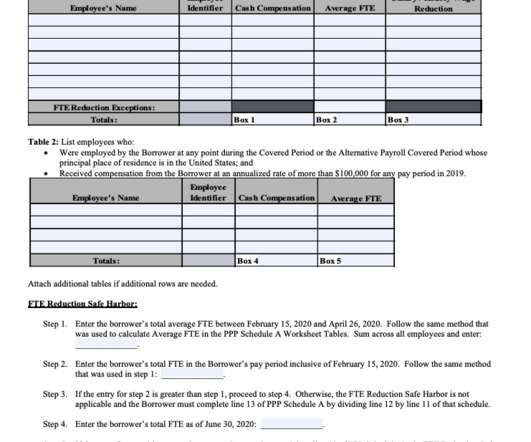

(Photo by Carlos Muza on Unsplash ) A Framework for Choosing Suitable AR Metrics Businesses should carefully assess their specific needs, objectives, and operating context when selecting metrics for accounts receivable (AR) performance measurement. We are currently offering 33 percent off our standard small business consulting rates.

Let's personalize your content