Overcoming the Challenges Caused by Disputes and Deductions

Your Virtual Credit Manager

JANUARY 24, 2023

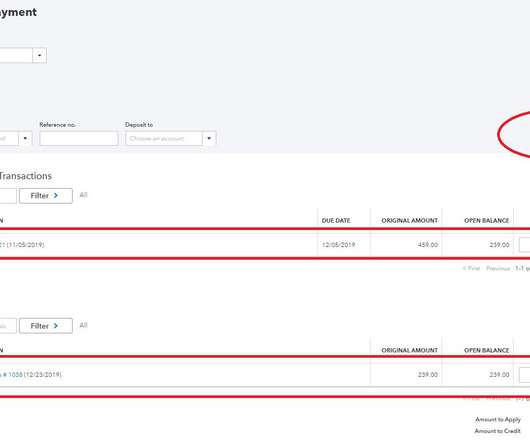

The bad news is that it is not for the full amount. Disputes and Deductions occur when a customer believes an order has not been satisfactorily fulfilled, or it has been invoiced incorrectly. Prove to them the accuracy of your invoice, and you should get paid. The good news is your customer has sent you a payment.

Let's personalize your content