RMAI Presents FinancialLiteracy.Rocks for Financial Capability Month

RMAi Blog

MARCH 31, 2023

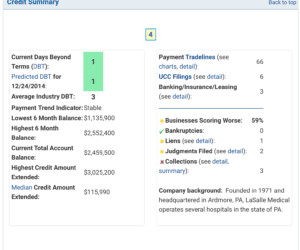

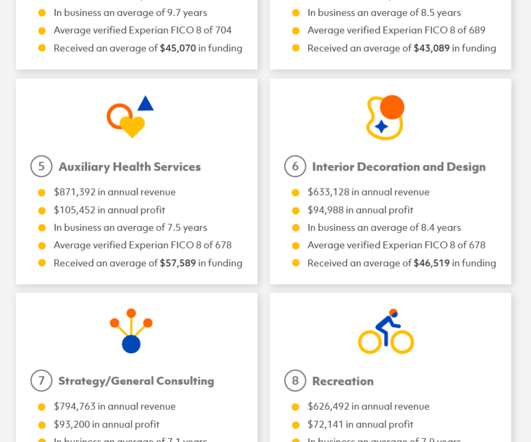

By Audience: Kids Young Adults College Students & New Grads Couples Adults Parents Service Members Business Seniors By Topic: Credit & Debt Savings & Budgeting Expenses Credit Score Loans Investments Vehicle Housing Retirement “RMAI is committed to consumer financial education, during Financial Capability Month and throughout the year.

Let's personalize your content