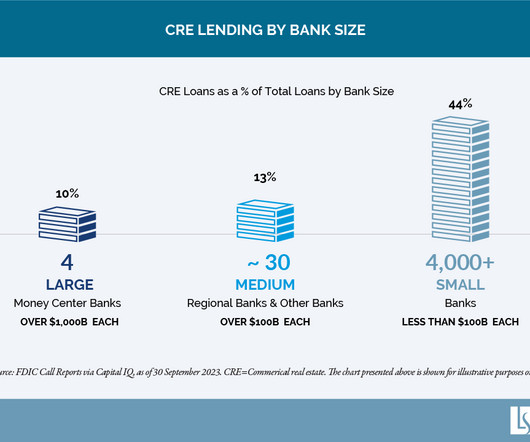

Waiting to Exhale: Commercial Real Estate Lending and Small Banks

Loomis Sayles Credit Research

FEBRUARY 13, 2024

1] Other providers of CRE debt include government-sponsored enterprises, securitizations (CMBS and REITs) and insurance companies. While non-performing loans have continued to grow, especially in the office and low-income consumer categories, most banks are not seeing widespread default risks in their loans outside of these two areas.

Let's personalize your content