Small Business Credit Management Consulting

Your Virtual Credit Manager

MARCH 13, 2023

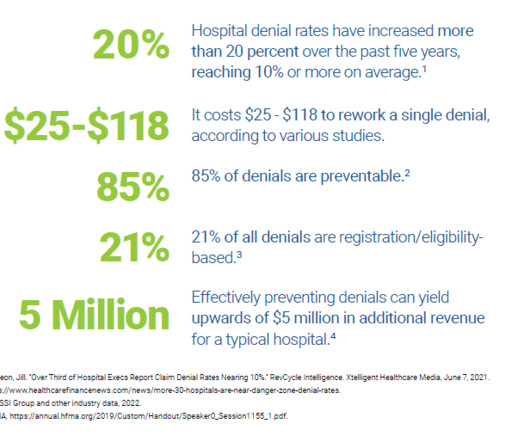

World class receivables management involves efficiently converting orders to cash while minimizing profit dilution. Many times companies find it challenging to do this, and when that happens, working capital and cash flow are impacted. Your Virtual Credit Manager works with SMBs to root out the system constraints, process inefficiencies and hidden risks that create unnecessary transactional friction, thereby diluting profitability and hindering cash flow.

Let's personalize your content