Misalignment Between Credit and Sales Spells Trouble

Your Virtual Credit Manager

FEBRUARY 27, 2024

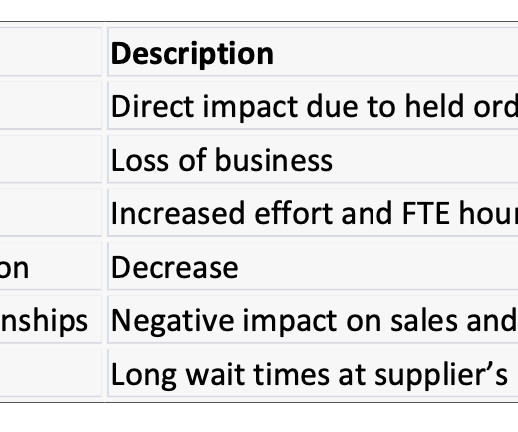

For a small business owner or executive, navigating credit decisions can be challenging, especially when they clash with the goals of other stakeholders within the company. Situations often arise when the prudent action involves denying credit to a potential customer, imposing limits on existing accounts, or delaying the fulfillment of large orders until payment is received.

Let's personalize your content