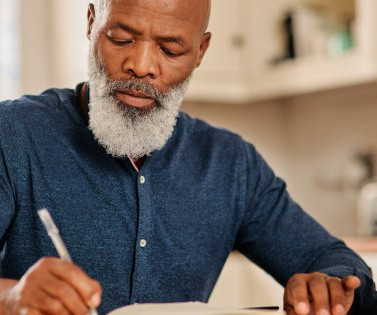

Retirement and Estate Planning for Broke Individuals

Due

MARCH 30, 2023

You can help your relatives immensely by setting up an estate plan now, regardless of who you are. Essentially, whatever you own makes up your estate. These assets could be: Any property your own Whatever money you have in a bank account Stocks, bonds, and mutual funds invested through a taxable brokerage account A Roth IRA Your prized vinyl, stamp, coin, or art collection Having a say in how your estate is distributed is essential to your estate planning.

Let's personalize your content