What is Digital Credit Management?

Credit Tools

OCTOBER 11, 2023

How is digital revolutionizing Credit Management? Why can we rejoice in this? Find our new tutorial!

Credit Tools

OCTOBER 11, 2023

How is digital revolutionizing Credit Management? Why can we rejoice in this? Find our new tutorial!

Your Virtual Credit Manager

OCTOBER 10, 2023

In larger organizations, those with credit professionals on staff, the credit function is sometimes disparaged as the “Stop Sales” department. When that’s the case, it’s clear that sales and credit are not properly aligned and the resulting friction is bad for business. (Photo by krakenimages on Unsplash ) The purpose of having a credit function is to ensure a profitable sale.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Due

OCTOBER 13, 2023

In the fast-paced world of business and entrepreneurship, learning from successful individuals is invaluable. In this blog post, we’ll dive into a video transcript featuring insights from millionaires and billionaires. These entrepreneurs share their 13 rules for success, including adaptability, ambition, and dealing with pressure. So, without further ado, let’s explore these rules and get inspired by their experiences. 1.

Sky Business Credit

OCTOBER 12, 2023

Running a successful business comes down to a few key factors; the most important one is cash flow. Factoring is a type of alternative financing that allows you to take control of your cash flow by selling your accounts receivable to a third party (also known as a factor) to obtain immediate working capital. Now, instead of waiting for your customers to pay based on 30-, 60-, or even 90-day terms, you get cash immediately, and the factor collects the payment later.

Waystar

OCTOBER 11, 2023

If you’ve ever had to chase down referral status from a payer, you know it’s a tedious, time-consuming process. Whether you’re calling payers or checking portals, referrals wreak havoc on efficiency — and they don’t stop there. If your organization routinely experiences delayed or extended referral processing, you risk everything from patient leakage to poor clinical outcomes.

Eagle Business Credit

OCTOBER 12, 2023

Many small business owners have been turning to accounting software for their bookkeeping needs. Software can be used with or without an accounting department, depending on how lean your business is. Accounting software has stepped in to fulfill the need of monitoring financials and minimizing errors in account processes, so does your small business need an accounting software?

Credit Management Source brings together the best content for credit management professionals from the widest variety of industry thought leaders.

Lendio

OCTOBER 11, 2023

With 10 million new small businesses opening their doors in the U.S. in 2021-2022—the highest years on record—a Lendio study reveals the top industries for starting a business. As the U.S. experiences this small business boom, Lendio analyzed which industries are most likely to grow and succeed in the next decade, helping to answer the question: What industry should new entrepreneurs explore?

Accounting Department

OCTOBER 10, 2023

When running a business, keeping track of expenses can be a daunting task. From petty cash expenses to vendor payments, you need to ensure every penny spent is accounted for. That's where expense reports come in.

Abrigo

OCTOBER 10, 2023

How industry analysis can improve your credit risk management Understanding your customers' businesses leads to better loan pricing, structure, and risk management. You might also like this webinar series, "Tackling common credit risk questions during challenging times." WATCH WEBINARS Takeaway 1 All businesses perform industry analysis, but financial institutions in particular must know their customers' competitive landscape.

Credit Management Group UK

OCTOBER 11, 2023

We would like to think that the information we share on a weekly basis is useful and helps you in your day to day business. There are many areas in Credit Management we can help with and alot of the problems could be solved by setting up the right systems in the first place. Internally we have alot of processes we follow to allow us to make the decision if we want to take on a new client just like you would.

Lendio

OCTOBER 12, 2023

Supporting Black-owned businesses is a tangible way to foster economic equity and empowerment in the black community. These businesses contribute significantly to local economies, create jobs, and offer unique products and services that enrich our communities. However, these businesses also face unique challenges. This post explores what it’s like to be a Black entrepreneur today and ways to support Black-owned businesses.

Accounting Department

OCTOBER 13, 2023

In this episode, join Kevin, Alicia, and Sarah as they discuss the setup and execution of various fantasy sports leagues throughout the year.

Abrigo

OCTOBER 10, 2023

Loan review issues include staffing challenges and training. Last year's 2022 Loan Review Survey by Abrigo found these four common challenges in effective loan review. Review the 2023 Loan Review Survey results with experts and get their take on emerging trends and best practices register for Webinar Takeaway 1 Effective loan review requires experienced staff, well-organized outsourcing, or a combination of the two.

Chaser

OCTOBER 10, 2023

Timely payments are essential for businesses to maintain a healthy cash flow , enabling them to pay their employees, cover operating costs, and make investments that drive growth. Unfortunately, the ongoing late payment crisis has been a significant challenge for many businesses, particularly small and medium-sized enterprises. Late payments are a growing concern, as highlighted by Xero's data from 2019 , which reported that 48% of invoices faced payment delays each month on average.

Loomis Sayles Credit Research

OCTOBER 13, 2023

With tight spreads and elevated valuations in many credit markets, we think the asset-backed securities (ABS) space currently stands out as a bright spot in the credit landscape. In our view, the asset class offers nice spread, high yield, low duration and positive excess return potential versus Treasurys in the months ahead. Investors can consider a wide range of securities within this varied sector.

Accounting Department

OCTOBER 12, 2023

Inventory management is crucial for any business, regardless of its size or industry. But, as a business owner, you may wonder how often you should perform a thorough inventory check.

Abrigo

OCTOBER 10, 2023

Use the fraud triangle to prevent fraud at your institution The concept of the fraud triangle is frequently used in business, accounting, and criminology. How can you put it to use at your financial institution? Would you like other articles like this in your inbox? Takeaway 1 The fraud triangle concept describes three factors that, when combined, incentivize a person to commit fraud.

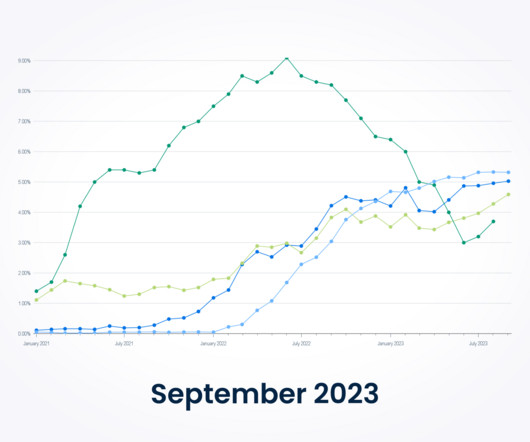

Reorg Blog

OCTOBER 11, 2023

The post EMEA Monthly Rating Actions – September 2023: Even Number of Positive, Negative Rating Actions; Median Yield in BB, B Category at 8%; Increased Yield Dispersion as Ratings Fall Below B appeared first on Reorg.

StackSource

OCTOBER 12, 2023

CEO Tim Milazzo and Director of Capital Markets Huber Bongolan recently went live to share a comprehensive update on the current state of commercial real estate capital markets.

blue dot counseling

OCTOBER 9, 2023

I stopped doing my books when I realised I was making them worse The post I stopped doing my books when I realised I was making them worse! appeared first on Blue Dot Consulting.

Abrigo

OCTOBER 10, 2023

Loan review issues include staffing challenges and training. Last year's 2022 Loan Review Survey by Abrigo found these four common challenges in effective loan review. Review the 2023 Loan Review Survey results with experts and get their take on emerging trends and best practices register for Webinar Takeaway 1 Effective loan review requires experienced staff, well-organized outsourcing, or a combination of the two.

Reorg Blog

OCTOBER 12, 2023

The post Tear Sheet: Hilong Earnings Quality Mediocre Despite O&G Upcycle; CNY 700M Related Party Asset Sale Pivotal to Potential LME Scenarios for Due ‘24 SSNs, Raises Question on Future Business/ Financial Profile; Due ‘24 Fair Value Estimate: Low-60s, Skewed to Downside appeared first on Reorg.

Biz2X

OCTOBER 13, 2023

Reading Time: 4 minutes Partnerships have emerged as a compelling avenue for financial institutions of all sizes to engage in collaborative ventures with startup entrepreneurs, fintech firms, and small business owners. The overarching objective of these partnerships is twofold: augmenting revenues while enhancing the overall customer experience. A notable benefit for financial institutions, particularly in collaborations with fintech entities, is the access to cutting-edge technologies and softw

blue dot counseling

OCTOBER 13, 2023

Towards the end of this burst of activity the accounting processes should be working on "autopilot" and everyone can concentrate again on delivering the profit and achieving growth potential of the business. The post Is my accounting any good? appeared first on Blue Dot Consulting.

TreviPay

OCTOBER 13, 2023

In this second installment of our three-part blog series, we take a closer look at the payments experience B2B buyers want from their sellers. In the first installment of the series, B2B Sales Strategy: Where Buyers Say Sellers Are Falling Short , we discussed the top barriers buyers face when making purchases and payments. This blog is based on our most recent research, The Data Is In: B2B Buyers Expect a Better Payments Experience.

Reorg Blog

OCTOBER 12, 2023

Codere is going through its fourth debt restructuring since 2015 as it grapples with sluggish profitability, slower-than-expected recovery from Covid-19, and regulatory restrictions in Mexico and Argentina.

Biz2X

OCTOBER 13, 2023

Partnerships have emerged as a compelling avenue for financial institutions of all sizes to engage in collaborative ventures with startup entrepreneurs, fintech firms, and small business owners. The overarching objective of these partnerships is twofold: augmenting revenues while enhancing the overall customer experience. A notable benefit for financial institutions, particularly in collaborations with fintech entities, is the access to cutting-edge technologies and software solutions without th

Due

OCTOBER 13, 2023

As an economic factor, inflation profoundly influences market behavior, as seen in recent United States events. The numbers released in the news indicate that inflation rates exceeded expectations, jeopardizing the market’s stability in various ways. This article addresses these issues, seeking to decode what this could mean for average consumers and investors in the market.

Chaser

OCTOBER 13, 2023

Collections can be among the most challenging and frustrating aspects of running a business. It can be challenging to navigate the delicate balance between maintaining good relationships with clients and ensuring that payment is received promptly. In many cases, collections emails are essential to this process, serving as a reminder and prompting clients to make their payments.

Reorg Blog

OCTOBER 11, 2023

Reorg is launching a global quarterly report highlighting liability management exercises, or LME, used by stressed creditors to partially refinance capital structures. The report summarizes “aggressive” transactions completed by U.S. and European borrowers that, among other results, raise cash, extend maturities or reduce outstanding principal. Transactions typically result in participating stakeholders improving their ranking relative to nonparticipating creditors.

Lendio

OCTOBER 12, 2023

From finance and insurance to mining to real estate, veterans are making an impact in every industry you can imagine. Veterans now own more than 2.5 million businesses in the U.S., and that number doesn’t appear to be slowing down. “You go through so much in the military, but really what the military is teaching you is how to be resilient,” said Dawn Halfaker , founder and CEO of Halfaker and Associates.

Let's personalize your content