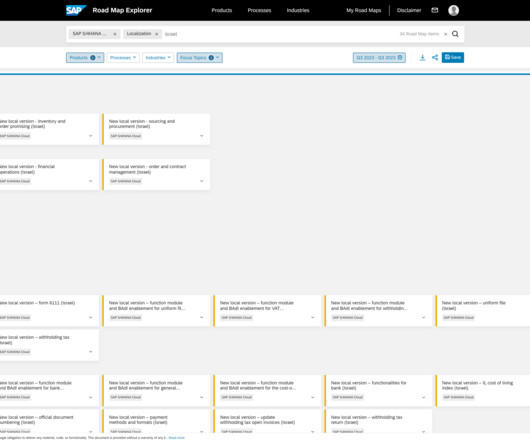

New Resource-Related Intercompany Billing in SAP S/4HANA Cloud

SAP Credit Management

AUGUST 10, 2023

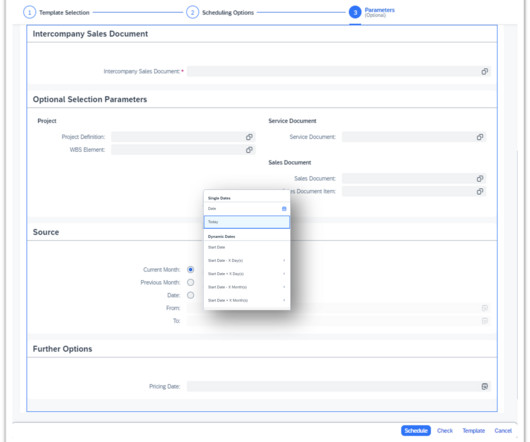

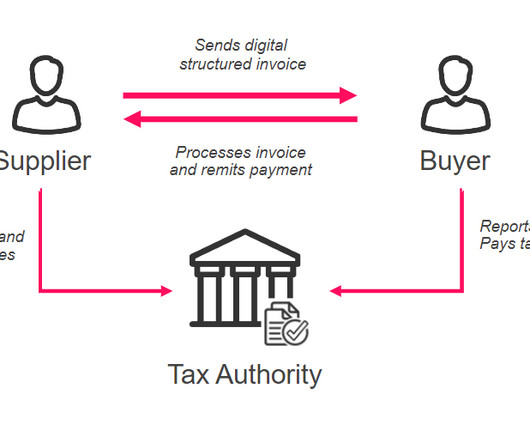

Consequently, resource-related intercompany billing has become a crucial process for cross-company billing of intercompany services and expenses. In this blog, we discuss the primary motivations and prominent features of the new intercompany billing solution Why new Resource-Related Intercompany Billing in S/4HANA Cloud, Public Edition?

Let's personalize your content