Guide to Business Debt

Lendio

APRIL 30, 2024

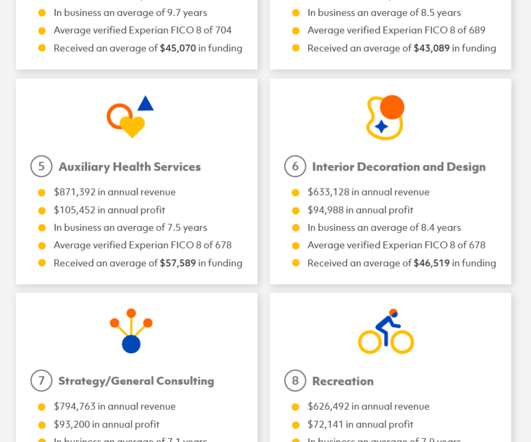

Debt is often used for investments in areas like real estate, inventory, equipment, or acquiring another business that will increase profitability and contribute to long-term success. Healthcare Healthcare providers can use loans to invest in new medical equipment, expanding their services. Market conditions.

Let's personalize your content