Gleaning Actionable Insights from Credit Scores

Your Virtual Credit Manager

APRIL 2, 2024

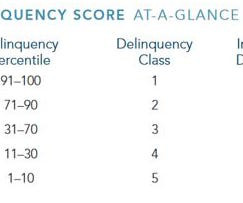

Scores provide valuable insights into the creditworthiness of business customers and help companies make informed decisions regarding trade credit extension, terms, and risk management strategies. Setting Credit Terms: Scores help the person doing the analysis determine appropriate credit terms, such as credit limits and payment terms.

Let's personalize your content