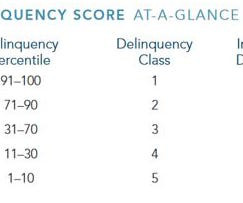

“Must Have” Metrics for Receivables Management

Your Virtual Credit Manager

MAY 14, 2024

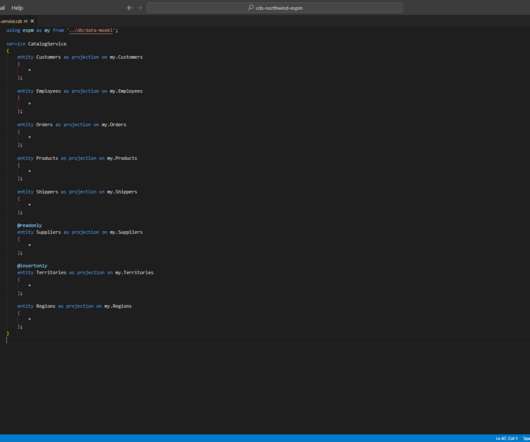

Even if your accounting solution isn’t robust, it should allow you to export your AR details into a spreadsheet that can then be used to create the needed reports and metrics. Photo by Myriam Jessier on Unsplash The alternative. running short of cash can be a disaster! Photo by Myriam Jessier on Unsplash The alternative.

Let's personalize your content