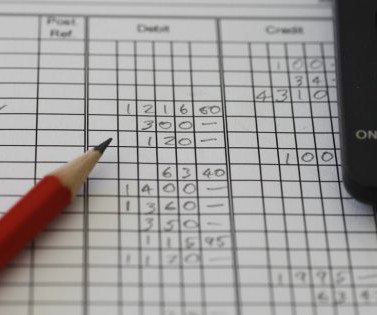

Bookkeeping 101: What are Liabilities?

Lendio

APRIL 2, 2024

Paying the mortgage each month increases your asset: equity on the building or land. Their business equity can grow by paying liabilities. These can include loans and mortgages. They cover payroll tax and sales tax payable, along with the monthly payments you make on loans and mortgages.

Let's personalize your content