India Localization Compliance Reports in S/4HANA Public Cloud

SAP Credit Management

FEBRUARY 9, 2023

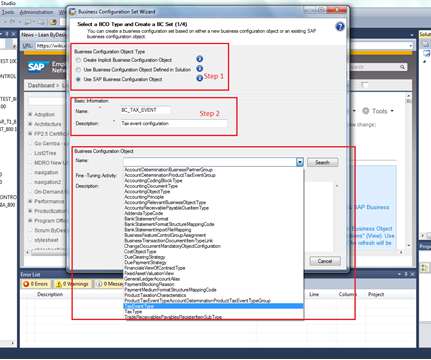

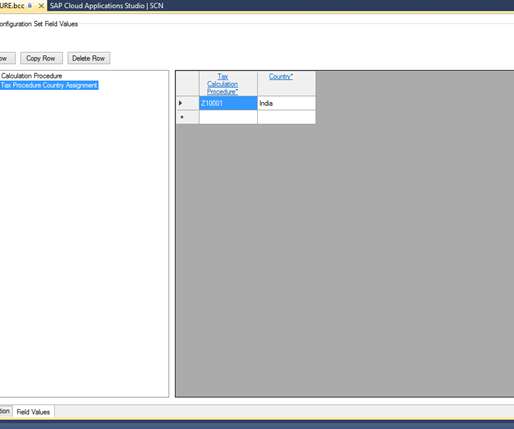

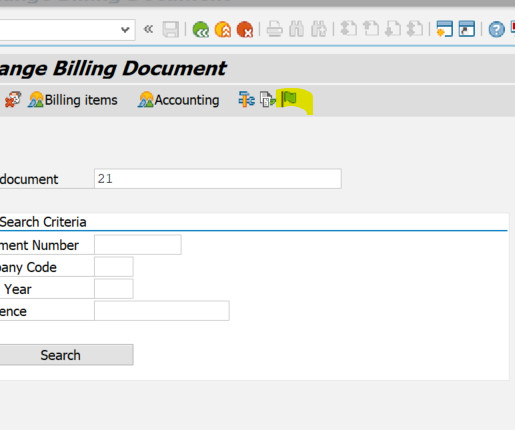

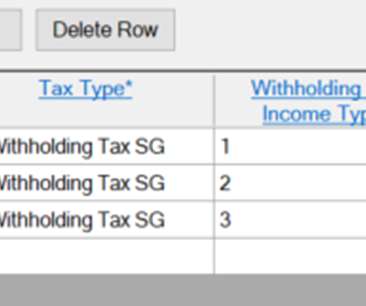

In todays blog post we will see how to generate GSTR1 Report. Assign Report Categories to Reporting Entity 4. Also you can download the tax items. Sample Jason and Tax report. Conclusion This blog post should help you to understand in detail how to generate India Compliance Reports. Configuration Steps 1.

Let's personalize your content