Forecasting Collections – A Key Element of Your Cash Flow

Your Virtual Credit Manager

NOVEMBER 28, 2023

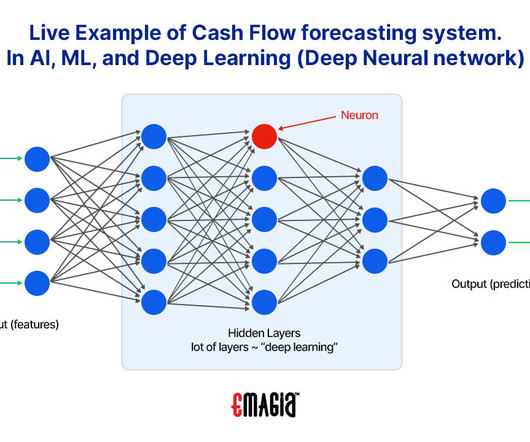

Cash forecasting is the process used for projecting how much cash you will have on hand in the future. Short term cash forecasting is usually done for every week of the forecast period, typically the current month. Longer term forecasts are useful for planning. How is Cash Forecasting Done?

Let's personalize your content